Average Car Insurance Price in New York

Factors Influencing Car Insurance Costs in New York

Source: cloudinary.com

Average car insurance price in new york – Several factors contribute to the price of car insurance in New York. Understanding these factors can help you make informed decisions and potentially save money on your premiums.

Driver Age and Driving History

Insurance companies consider driver age and driving history as key indicators of risk. Younger drivers, particularly those with less experience, are statistically more likely to be involved in accidents, resulting in higher premiums. A clean driving record, free of accidents and traffic violations, significantly reduces your risk profile and leads to lower premiums. Conversely, multiple accidents or speeding tickets will likely increase your rates.

For example, a 20-year-old with a clean record might pay significantly less than a 20-year-old with several speeding tickets and a previous at-fault accident.

Car Model

The make, model, and year of your vehicle significantly impact your insurance cost. Luxury cars and high-performance vehicles are generally more expensive to insure due to higher repair costs and a greater risk of theft. Conversely, less expensive and less powerful vehicles tend to have lower insurance premiums. The safety features of the car also play a role; vehicles with advanced safety technology might receive discounts.

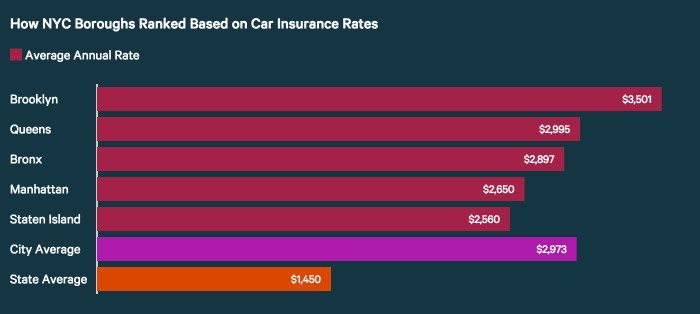

Location within New York State

Your location within New York State influences your insurance rates due to variations in accident rates and crime statistics. Urban areas with high population density and higher accident rates typically have higher insurance premiums compared to more rural areas. For instance, insuring a car in New York City will generally be more expensive than insuring the same car in a smaller town upstate.

Coverage Options, Average car insurance price in new york

The type and amount of coverage you choose directly affect your premium. Liability-only coverage, which is the minimum required by law, covers damages to other people’s property or injuries sustained by others in an accident you cause. Adding collision coverage (for damage to your vehicle in an accident) and comprehensive coverage (for damage caused by events other than collisions, such as theft or vandalism) will increase your premium, but also provides greater protection.

Credit Score

In many states, including New York, your credit score can be a factor in determining your insurance rates. Insurers often use credit-based insurance scores to assess risk. A good credit score generally correlates with lower premiums, while a poor credit score can lead to higher premiums. This is because individuals with good credit are statistically less likely to file fraudulent claims.

Average Costs by Coverage Type

The average annual premiums for different coverage types in New York vary significantly. The following table provides a general comparison, keeping in mind that individual rates depend on the factors discussed above.

| Year | Coverage Type | Average Premium | Premium Range |

|---|---|---|---|

| 2024 | Liability Only | $600 | $400 – $800 |

| 2024 | Liability with Collision | $1200 | $900 – $1500 |

| 2024 | Full Coverage | $1800 | $1500 – $2100 |

The difference between minimum coverage (liability only) and comprehensive coverage can be substantial, reflecting the increased protection offered by the latter. Comprehensive coverage provides significantly broader protection against a wider range of risks.

Deductible Impact on Premiums

| Deductible | Average Premium Difference |

|---|---|

| $250 | + $100 (compared to $500 deductible) |

| $500 | Base Premium |

| $1000 | – $150 (compared to $500 deductible) |

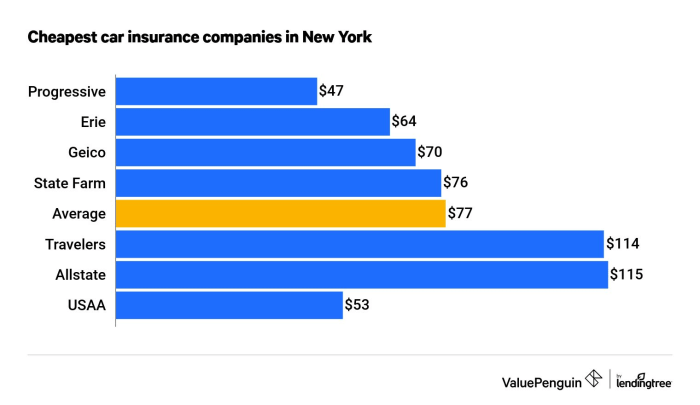

Comparing Insurance Companies in New York: Average Car Insurance Price In New York

Numerous insurance companies operate in New York, each offering different rates and policy features. Comparing quotes from several providers is crucial to finding the best deal.

Major Car Insurance Providers and Rate Comparison

Source: cloudinary.com

Three major providers – State Farm, Geico, and Progressive – often show variations in their average rates. These variations can be influenced by individual driver profiles, vehicle type, and location. It’s important to obtain personalized quotes from each company to make an accurate comparison. For example, one company might offer lower rates for younger drivers while another might provide better discounts for safe driving records.

Beyond pricing, these companies differ in policy features such as roadside assistance, rental car reimbursement, and customer service responsiveness. Some may offer more robust mobile apps or online tools for managing policies.

Methods for Reducing Car Insurance Costs

Several strategies can help you lower your car insurance premiums. Implementing these measures can lead to significant savings over time.

Strategies to Lower Premiums

- Maintain a clean driving record.

- Complete a defensive driving course.

- Bundle your home and auto insurance.

- Take advantage of good student discounts.

- Explore safe driver discounts.

- Choose a higher deductible.

Illustrative Examples of Insurance Premiums

Let’s illustrate how different factors can impact insurance costs with some examples.

Scenario 1: Young Driver in a Major City

A 20-year-old driver with a new car in New York City can expect to pay significantly more than an older driver with an established driving record in a rural area. The higher density of vehicles and accidents in the city, combined with the higher risk associated with a young driver, will result in a higher premium.

Scenario 2: Bundling Home and Auto Insurance

Bundling your home and auto insurance with the same company often results in significant savings. Insurers frequently offer discounts for bundling policies, rewarding customer loyalty and simplifying their administration.

Scenario 3: Clean Record vs. Multiple Accidents

A driver with a clean driving record will pay considerably less than a driver with multiple accidents. Each accident increases the perceived risk, leading to higher premiums. The difference can be substantial, particularly if the accidents resulted in significant damages or injuries.

Questions Often Asked

What is the cheapest car insurance in New York?

The cheapest car insurance in New York varies depending on individual factors. Comparing quotes from multiple insurers is essential to find the most affordable option for your specific profile.

How often can I change my car insurance in New York?

You can generally change your car insurance policy in New York whenever your current policy allows. Check your policy for details on cancellation and renewal periods.

Do I need SR-22 insurance in New York?

Average car insurance prices in New York can vary significantly depending on several factors. Naturally, the cost of insuring a luxury vehicle like an Audi A8 will be considerably higher than a more economical model; you can check the audi a8 new car price to better understand the vehicle’s value. This higher value directly impacts insurance premiums, so budget accordingly when considering both purchase and ongoing insurance costs in New York.

SR-22 insurance is required in New York for drivers with certain driving violations or convictions, such as DUI or multiple moving violations. It provides proof of insurance to the state.

Can I pay my car insurance monthly in New York?

Most insurers in New York offer monthly payment plans, though this may involve additional fees. Check with your insurer for their payment options.